Reinsurance tokenization is rapidly emerging as a transformative force in both the insurance and crypto investment landscapes. By leveraging blockchain infrastructure, this innovation is granting crypto investors access to the traditionally closed $750 billion reinsurance market, while offering uncorrelated, stable yield opportunities that stand apart from typical DeFi protocols. The convergence of real-world assets (RWAs), such as reinsurance contracts, with decentralized finance is not just a technical milestone – it is redrawing the boundaries of what yield generation means in the digital era.

How Blockchain Insurance Yield Is Changing Investor Access

Historically, reinsurance has been the domain of large institutions and specialist funds. The capital requirements, regulatory hurdles, and opaque deal structures kept retail and even many institutional investors at bay. Today, platforms like OnRe and Re are rewriting these rules by issuing tokenized reinsurance products on public blockchains such as Solana and Avalanche. These platforms are not simply digitizing existing securities; they are fractionalizing risk exposure, democratizing access, and enabling near-instant settlement for investors worldwide.

OnRe’s latest structured product connects $225 billion in stable assets to reinsurance pools via Solana, targeting yields up to 36.5%. Returns are generated from three distinct sources: underlying reinsurance performance, collateral yield from stablecoins or treasuries backing the contracts, and additional token incentives for early adopters. This multi-pronged approach creates a robust yield profile that is largely uncorrelated with traditional equities or crypto market cycles.

Similarly, Re’s tokenized funds on Avalanche have attracted high-profile commitments – Nexus Mutual alone allocated $15 million. Re’s focus on low-volatility insurance lines like property and workers’ compensation aims to deliver annualized returns up to 23%, providing a defensive alternative for DeFi-native capital seeking stability without sacrificing double-digit yields.

The Mechanics of Fractional Reinsurance Crypto Products

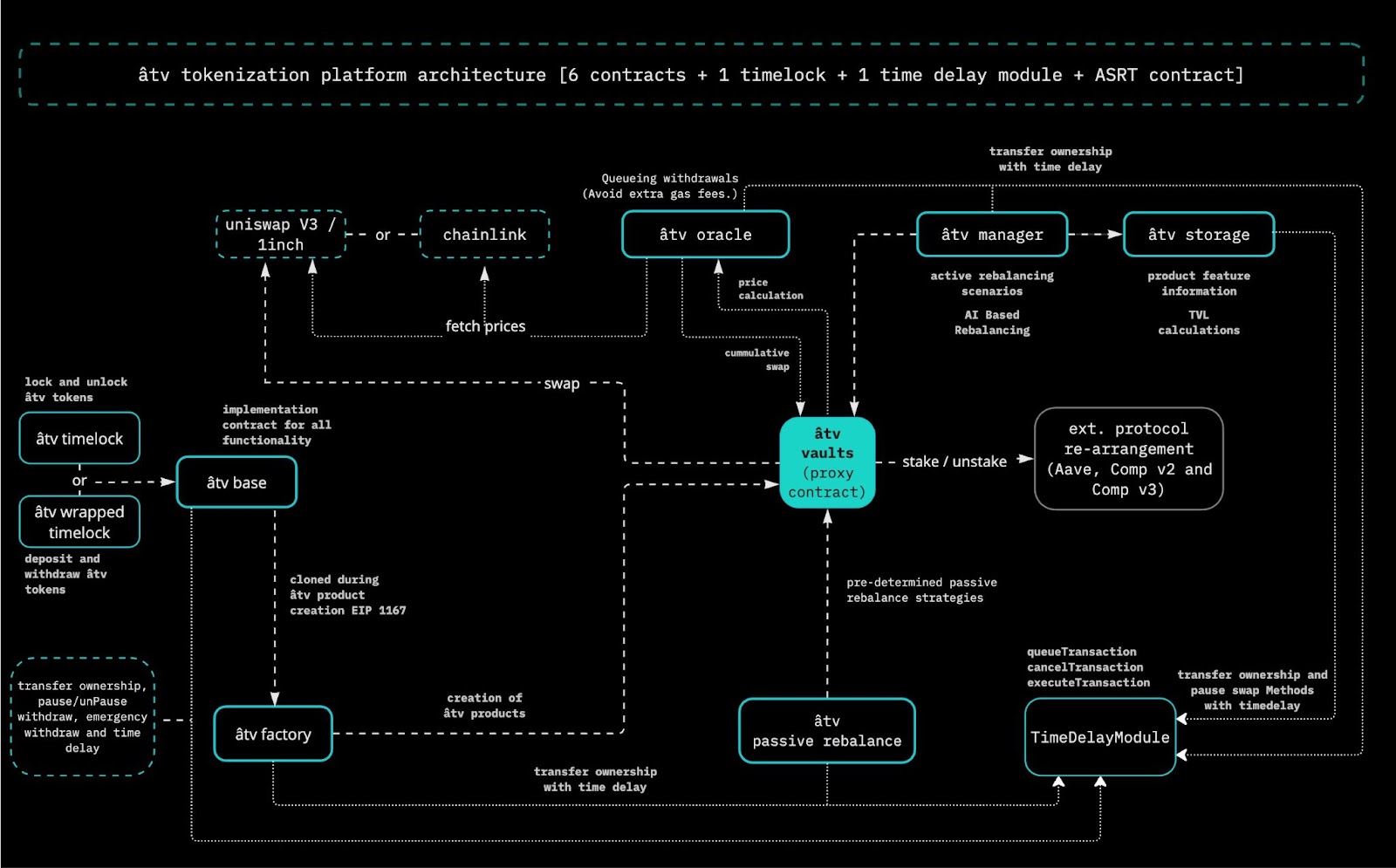

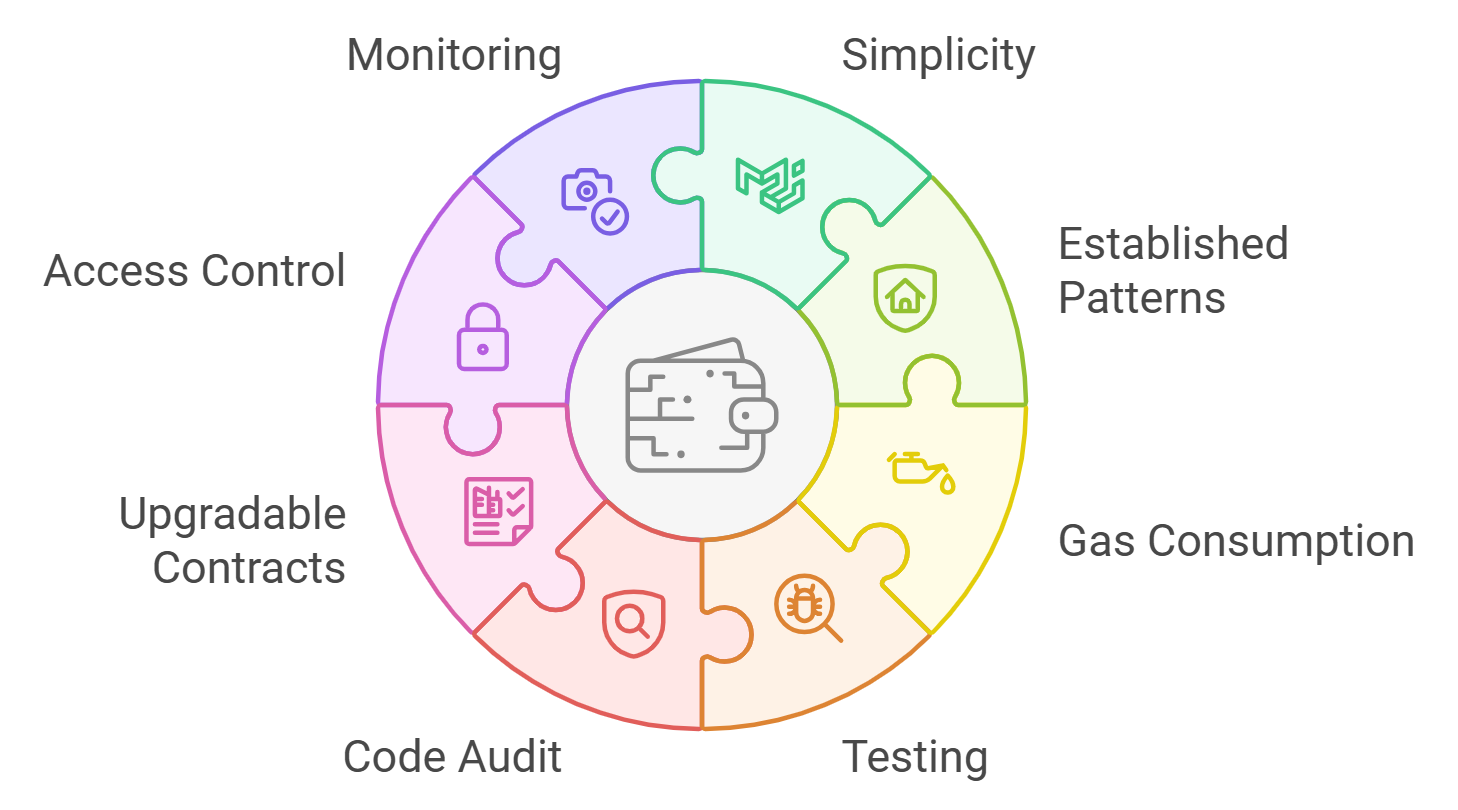

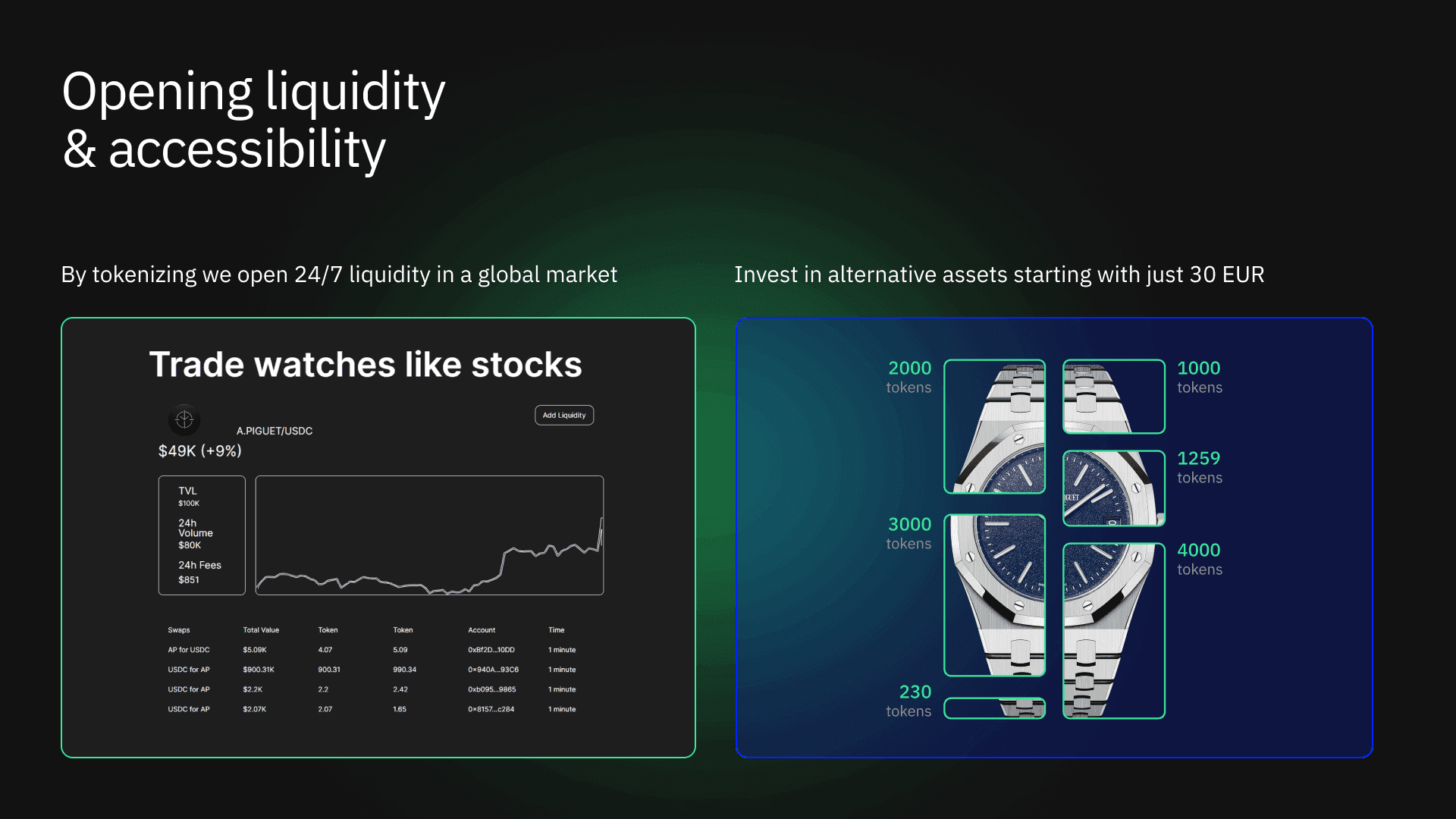

The key innovation lies in how these platforms structure their offerings. Through smart contracts and rigorous on-chain auditing, capital provided by investors is pooled as collateral backing real-world insurance risk transfer agreements. Each token represents a fractional share in these pools – unlocking liquidity options previously unavailable in legacy markets.

Key Benefits of Tokenized Reinsurance for Crypto Investors

-

Attractive, Uncorrelated Yield Opportunities: Tokenized reinsurance products offer yields of up to 36.5% (OnRe) and 23% (Re), providing stable returns that are uncorrelated with traditional crypto or equity markets.

-

Enhanced Diversification for Crypto Portfolios: By integrating real-world assets (RWAs) like reinsurance contracts, investors can diversify away from crypto-native risks and gain exposure to insurance underwriting profits and collateral yields.

-

Fractional and Democratized Market Access: Blockchain tokenization allows fractional investment in reinsurance, lowering entry barriers and enabling broader participation from accredited crypto investors.

-

Increased Transparency and Operational Efficiency: Platforms such as OnRe (on Solana) and Re (on Avalanche) leverage blockchain for transparent, auditable transactions, improving capital flow and reducing operational friction for investors.

This new paradigm offers several advantages:

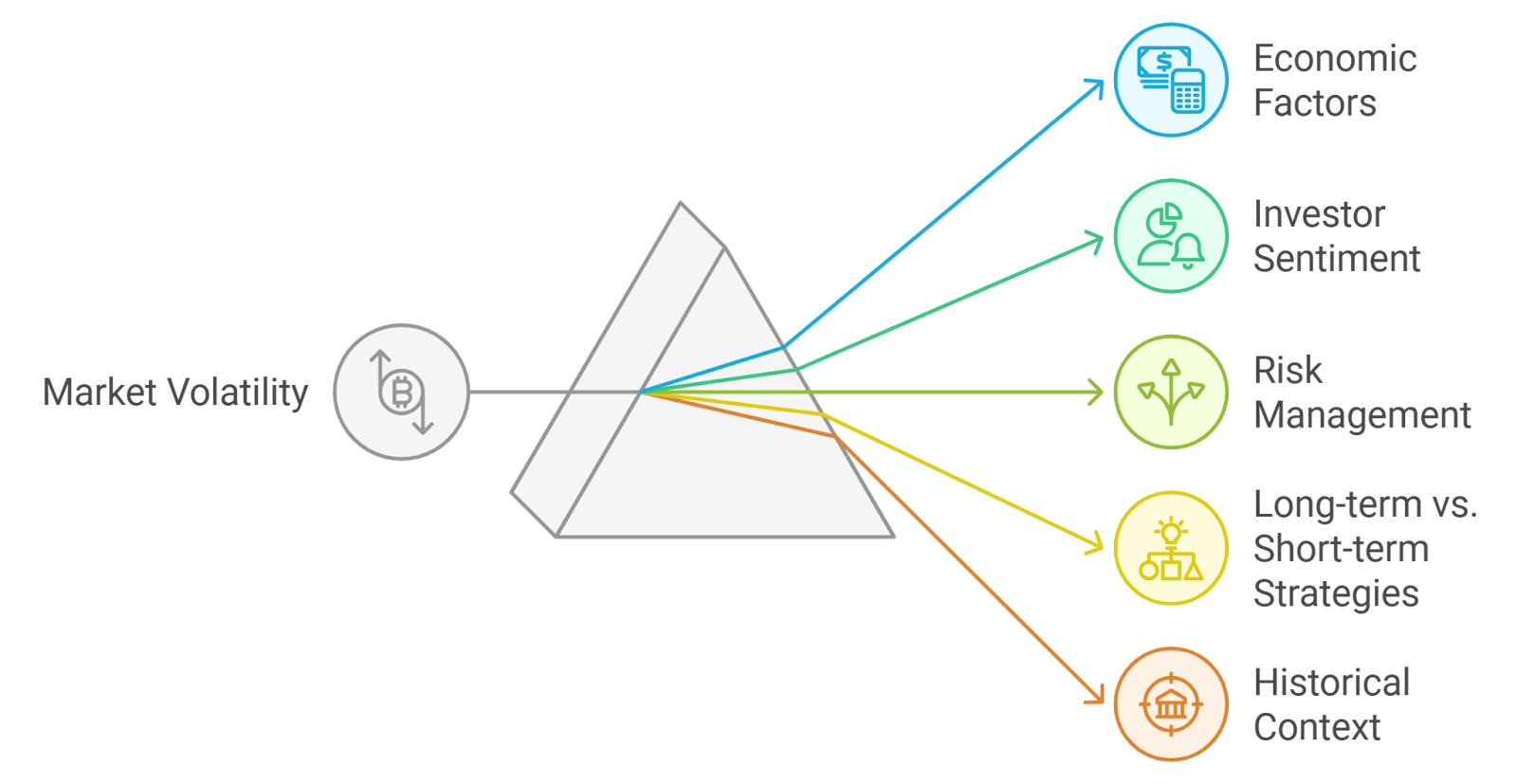

- Diversification: Returns from underwriting profits are typically uncorrelated with macroeconomic shocks or crypto volatility.

- Transparency: Blockchain records provide real-time auditability for premium flows, claims payments, and reserve levels.

- Efficiency: Automated settlements reduce costs for both insurers and investors – increasing net yields compared to traditional ILS (Insurance-Linked Securities).

- Accessibility: Fractionalization lowers minimum investment thresholds to hundreds instead of millions of dollars.

The result? A new class of blockchain insurance yield instruments that rival high-yield DeFi protocols but are grounded in real-world risk transfer rather than speculative leverage or unsustainable emissions.

Pioneers Setting Yield Benchmarks: Oxbridge Re and SurancePlus

The competitive landscape is heating up as more issuers enter the space. Oxbridge Re’s latest 2025 offerings include EtaCat Re (20% balanced yield) and ZetaCat Re (42% high-yield), giving sophisticated investors a menu of risk-return profiles based on appetite. SurancePlus touts projected annualized returns as high as 42% on its tokenized reinsurance securities – all backed by actual contract performance rather than synthetic derivatives.

This marks a profound shift: instead of chasing volatile altcoins or overleveraged lending pools, crypto investors can allocate capital into professionally managed risk portfolios whose performance depends on global insurance outcomes rather than speculative trading activity.

Platforms like OnRe and Re are not only capturing institutional attention but also catalyzing a broader movement toward the integration of real world asset DeFi. The ability to tokenize reinsurance risk means that investors can now balance their portfolios with assets that thrive on insurance fundamentals, rather than market speculation. This is especially relevant in periods where both crypto and traditional markets exhibit heightened correlation or systemic stress.

Another breakthrough is the democratization of capital access. By lowering minimum entry points, tokenized reinsurance pools allow a much wider range of investors to participate in a market once reserved for global reinsurers and hedge funds. The transparency afforded by blockchain ensures that every premium payment, claims disbursement, and reserve adjustment is recorded immutably, an auditable trail that was previously unimaginable in the legacy reinsurance world.

Navigating Tokenized Reinsurance Risks

Despite its promise, tokenized reinsurance is not without risks. Investors must understand that returns are ultimately tied to the underlying insurance contracts, unexpected catastrophic events or poor underwriting can impact yield performance. Smart contract vulnerabilities and regulatory uncertainty also require careful due diligence. Platforms like OnRe and Re mitigate these exposures through diversified pools, robust risk modeling, and third-party audits, but participants should still approach these products with a sophisticated risk management mindset.

The emergence of fractional reinsurance crypto products also brings questions about liquidity. While secondary trading venues exist for some tokens, market depth can vary by platform and product type. Investors should evaluate lock-up periods, redemption policies, and counterparty frameworks before allocating significant capital.

Key Due Diligence Steps for Tokenized Reinsurance

-

Understand Yield Structure and Underlying Assets: Analyze how yields are generated—such as OnRe’s up to 36.5% returns from reinsurance performance, collateral yield, and token incentives—and verify the types of reinsurance contracts (e.g., property, workers’ compensation) backing the tokens.

-

Evaluate Blockchain Infrastructure and Security: Confirm that the platform leverages robust, reputable blockchains (e.g., Solana for OnRe, Avalanche for Re) and employs rigorous security audits, multi-signature custody, and transparent on-chain reporting.

-

Review Regulatory Compliance and Investor Eligibility: Check for clear disclosures regarding investor qualifications (e.g., accredited investor status for Re funds), compliance with relevant securities laws, and any jurisdictional limitations.

-

Analyze Risk Factors and Diversification: Scrutinize the risk profile of the reinsurance contracts (e.g., exposure to catastrophic events), loss mitigation strategies, and whether the platform offers diversified pools to reduce single-event risk.

-

Verify Transparency and Reporting Standards: Ensure regular, detailed reporting on portfolio performance, claims history, and collateralization levels, ideally with on-chain data accessible to investors.

The Road Ahead: From Niche to Mainstream

The rapid growth of on-chain reinsurance signals a structural evolution in both insurance finance and DeFi infrastructure. As more platforms launch regulated offerings with transparent reporting standards, expect tokenized reinsurance to become a cornerstone allocation for sophisticated digital asset portfolios seeking uncorrelated yield.

For those looking to deepen their understanding of how these products deliver sustainable returns, and how they fit into the broader landscape of blockchain insurance yield, explore our in-depth resources on how tokenized reinsurance pools deliver real yield on-chain.

The convergence of institutional-grade risk management with open blockchain rails is setting new standards for transparency, efficiency, and investor empowerment. As adoption accelerates and yields remain competitive, 36.5% on OnRe’s Solana product and up to 42% through SurancePlus, the next wave of crypto investors will likely look beyond native DeFi protocols toward this new class of real-world yield opportunities.