On-chain reinsurance pools are rapidly transforming how yield is generated from real-world insurance premiums, blending traditional risk transfer with blockchain transparency and efficiency. In the past, reinsurance was an opaque, institutionally dominated market. Today, platforms like OnRe and Re Protocol are introducing a new paradigm: anyone with digital assets can provide capital to decentralized pools that underwrite insurance risk, earning a share of premiums as yield. This development not only brings stable, uncorrelated returns into DeFi but also creates a bridge between crypto-native capital and the vast world of real asset insurance.

How On-Chain Reinsurance Pools Capture Yield from Insurance Premiums

The core mechanism behind on-chain reinsurance pools is straightforward yet powerful. Capital providers deposit digital assets, most commonly stablecoins like sUSDe or AUSD, into smart contract vaults. These pooled funds are then used as collateral to back reinsurance contracts with primary insurers. As policyholders pay their regular insurance premiums, a portion flows directly into the pool as revenue.

Unlike speculative DeFi yield strategies that depend on trading fees or token emissions, on-chain reinsurance pools generate yield from real-world economic activity. This means returns are driven by the fundamental need for risk protection in sectors like property and casualty, health, and catastrophe coverage, not by volatile crypto market cycles.

Platforms Leading the Charge: OnRe and Re Protocol

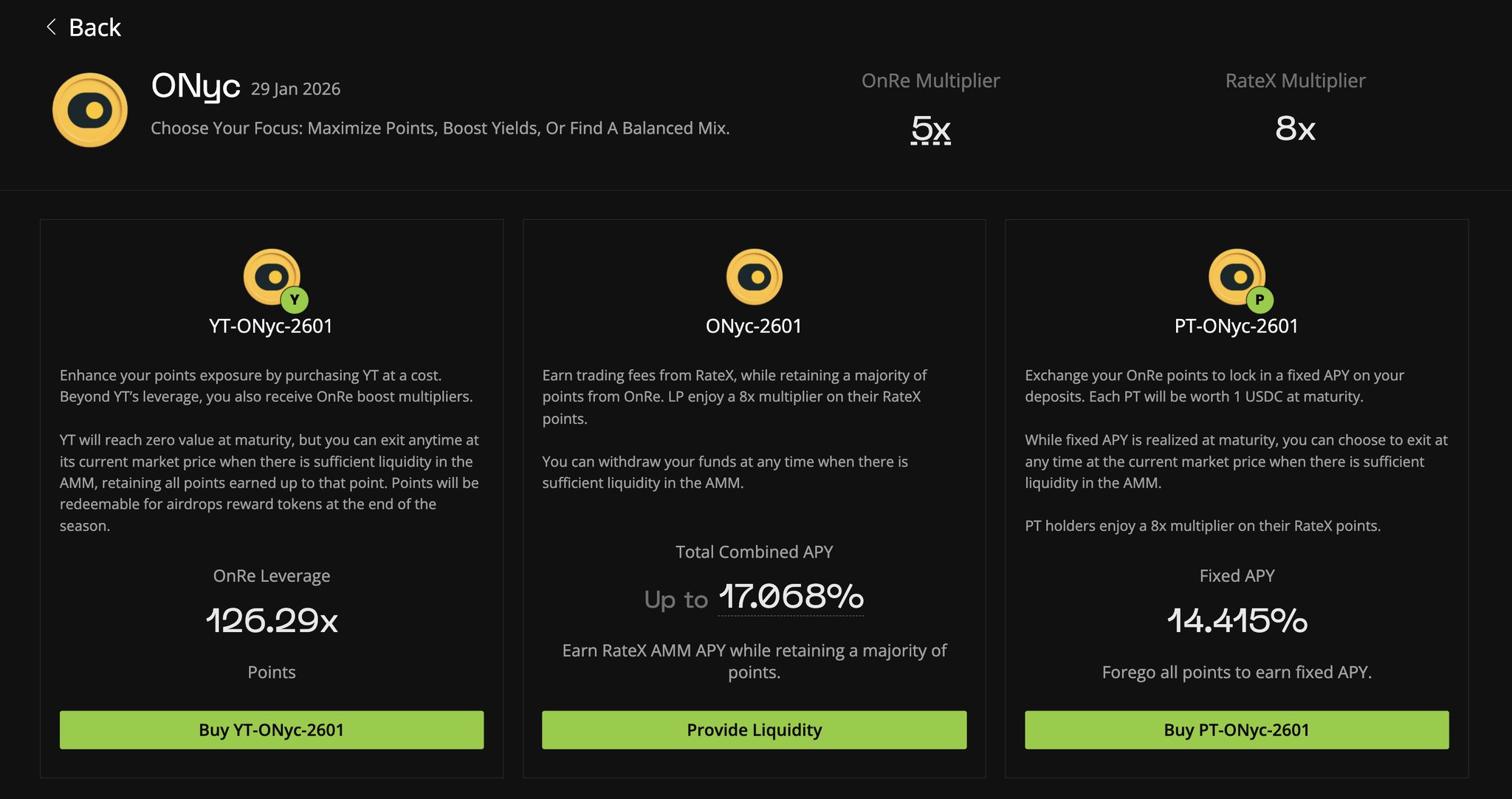

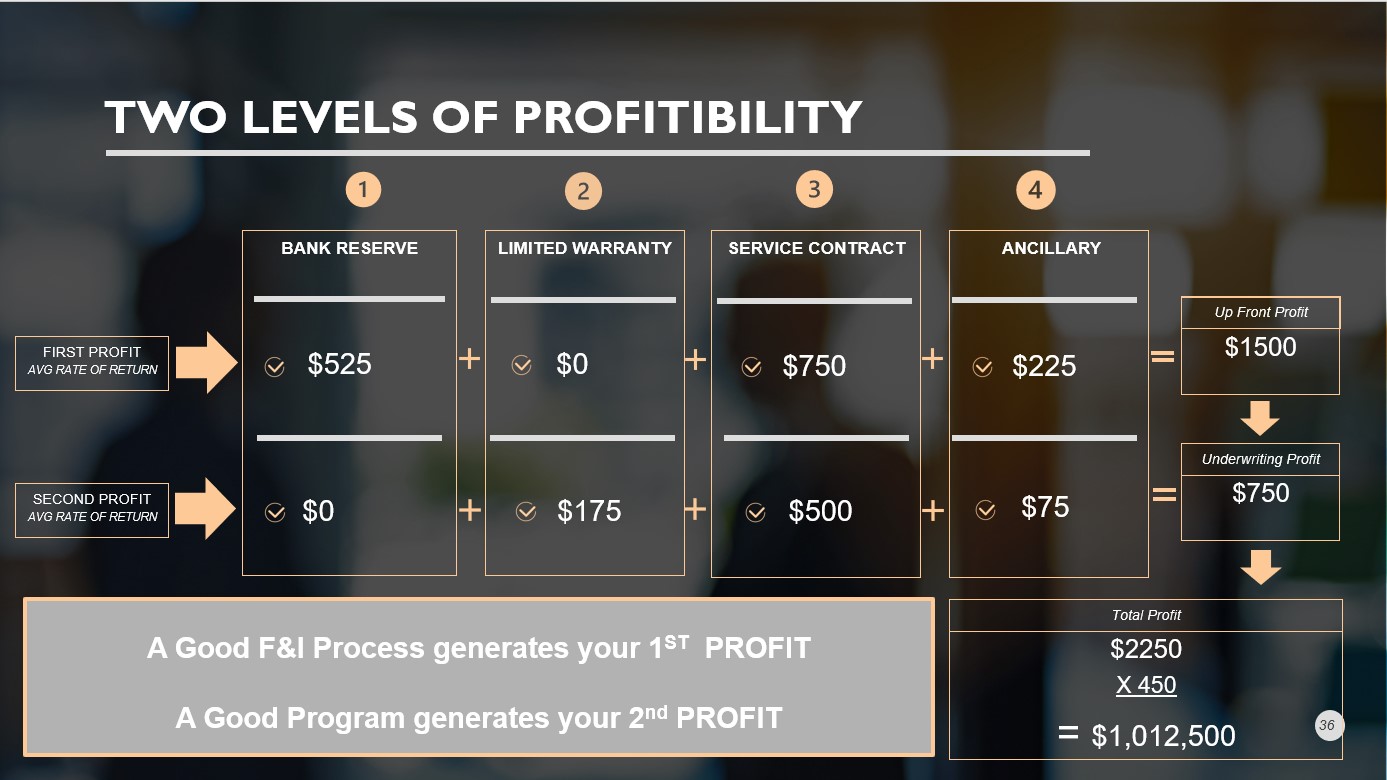

OnRe has emerged as a flagship platform in this space. Its ONyc token uses a multi-collateral model to support large-scale underwriting while targeting a base yield of 16%. Returns come from two sources: performance of the underlying reinsurance (i. e. , claims ratios vs. premiums) and additional yield generated by investing collateral assets in low-risk venues. Because this model is tied to actual insurance economics, it offers consistent returns even when crypto markets are bearish, a key differentiator for investors seeking stability.

Re Protocol, now live on Avalanche, provides institutional-grade access to regulated insurance programs via blockchain rails. Its permissioned pools enable capital allocators to tap into uncorrelated yields backed by fully collateralized, low-volatility insurance contracts, a major step forward for bringing real-world asset (RWA) opportunities into DeFi portfolios.

Key Benefits of On-Chain Reinsurance Pools for DeFi Investors

-

Stable, Uncorrelated Yield from Real-World Premiums: On-chain reinsurance platforms like OnRe and Re generate yield directly from insurance premiums, providing returns that are largely independent of crypto and equity market cycles.

-

Transparency and Efficiency via Blockchain: Blockchain-based reinsurance pools offer enhanced transparency, allowing investors to track capital flows and contract performance in real time, reducing the opacity common in traditional reinsurance.

-

Access to Institutional-Grade Insurance Markets: Platforms such as Re on Avalanche give DeFi users exposure to regulated insurance economics, traditionally reserved for institutional investors, through permissioned, on-chain frameworks.

-

Consistent Returns in Various Market Conditions: By leveraging real-world insurance risk, products like ONyc target base yields (e.g., 16%) that persist in both bull and bear markets, offering a reliable alternative to purely crypto-native yields.

-

Composability with DeFi Strategies: On-chain reinsurance tokens can be integrated into advanced yield-splitting and leverage strategies, enabling sophisticated portfolio construction and risk management for DeFi users.

The Composability Advantage: Integrating Real-World Yields into DeFi

One of the most compelling aspects of these platforms is their composability within the broader DeFi ecosystem. For instance, sUSDe holders can now access consistent reinsurance returns through OnRe’s vaults while still capturing upside during crypto bull cycles. Meanwhile, products like Opolis leverage Renzo Flow Vaults to tokenize healthcare reinsurance exposures, demonstrating how diverse risk types can be brought on-chain and made accessible through fixed-term vaults that pay out predictable yields.

This integration empowers both individual and institutional investors to diversify away from purely crypto-native risks and tap into multi-trillion-dollar traditional markets, all with blockchain-level transparency around capital flows and claims events. As tokenized reinsurance expands its reach across chains like Ethereum and Avalanche, expect more sophisticated structured products that combine real-world premium streams, stablecoin collateralization, and advanced risk management strategies.

Transparency is a recurring theme. With smart contracts automating premium collection and claims payouts, capital providers can monitor real-time pool performance, claims ratios, and yield accrual. This level of visibility is a stark contrast to legacy reinsurance, where capital flows and loss events are often hidden behind institutional reporting cycles. On-chain, every transaction is auditable, empowering investors to make informed decisions about risk exposure and capital allocation.

Another critical benefit is the uncorrelated yield profile these pools offer. Unlike most DeFi yield farms that fluctuate with crypto prices or protocol incentives, returns from on-chain reinsurance pools are fundamentally linked to insurance premium flows. This means that even during periods of market stress or crypto drawdowns, platforms like OnRe and Re Protocol can continue to deliver stable, predictable returns, often in the 10-16% range as targeted by ONyc, thanks to the steady nature of real-world insurance demand.

Risks and Considerations for Investors

Despite their promise, on-chain reinsurance pools are not without risks. Investors should be aware of underwriting risk (the chance that claims outpace premiums), smart contract vulnerabilities, and the regulatory landscape surrounding tokenized insurance products. Diversification across multiple pools, robust due diligence on collateral management, and understanding the underlying insurance contracts are all essential steps for mitigating exposure.

Key Risks Before Depositing into On-Chain Reinsurance Pools

-

Counterparty and Underwriting Risk: Returns depend on the performance of real-world insurance portfolios. If claims exceed premiums, or if underwriting standards are weak, capital in pools such as OnRe’s ONyc or Re could be depleted.

-

Regulatory Uncertainty: Platforms like Re and OnRe operate at the intersection of DeFi and regulated insurance markets. Regulatory changes could impact yield, access, or even the legality of participation.

-

Collateral Volatility and Liquidity: Pools often use stablecoins or restaked assets (e.g., AUSD in Renzo Flow Vaults). Depegging, liquidity crunches, or issues with collateral protocols could impact your ability to withdraw or the pool’s solvency.

-

Transparency and Data Reliability: While on-chain platforms promise transparency, evaluating the true risk exposure and claim history of underlying insurance contracts (especially with new products like ONyc) can be challenging.

For those comfortable with these risks, the upside is compelling. Not only do these products provide access to real-world asset (RWA) yield, but they also open the door to advanced DeFi strategies. For example, yield-splitting protocols now allow users to separate principal and yield tokens from reinsurance vaults, enabling tailored risk/return profiles or leveraged exposure to insurance premium flows. The ability to stack or compose these yields with other DeFi primitives, such as lending markets or structured notes, unlocks a new frontier of capital efficiency.

The market momentum is undeniable. As institutional allocators seek stablecoin-denominated, low-volatility yield sources, on-chain reinsurance is emerging as a credible alternative to traditional fixed income or corporate credit. Platforms like OnRe, Re Protocol, and Opolis are only the beginning: the next wave could see more specialized pools for niche risks (like climate catastrophe), cross-chain capital flows, and even tokenized secondary trading of reinsurance exposures.

“The insurance crisis is real. The opportunity is bigger. And now, it’s onchain. “ – Cee_ynthia on Medium

What Comes Next for Insurance Premium Yield Farming?

As on-chain reinsurance protocols mature, expect continued innovation in how real-world insurance premiums are harnessed for DeFi yield generation. From multi-collateral vaults like ONyc to permissioned institutional pools on Avalanche, the landscape is rapidly evolving, and the prize is enormous. The global reinsurance market is valued in the trillions, and only a fraction has been tapped by tokenized models so far.

For DeFi users seeking uncorrelated returns and exposure to real-world economic activity, on-chain reinsurance pools represent a paradigm shift. The convergence of blockchain transparency, composability, and insurance premium flows is forging a new asset class that sits at the crossroads of traditional finance and decentralized innovation.

To explore further how these mechanisms work and how you can participate, check out our in-depth guide: How Tokenized Reinsurance Pools Deliver Real Yield On-Chain.