Tokenized reinsurance pools are rapidly altering the landscape of on-chain insurance yields, pulling real-world risk into the crypto universe and delivering something DeFi has long craved: stable, uncorrelated returns. These aren’t just theoretical gains either – with platforms like Re Protocol, OnRe, and SurancePlus, we’re seeing double-digit projected yields that are backed by actual insurance contracts, not just speculative tokenomics. Let’s break down how these pools work and why they’re suddenly the hottest ticket in both institutional finance and crypto circles.

Tokenized Reinsurance Pools: The New Yield Engine

At their core, tokenized reinsurance pools convert bundles of insurance risk into blockchain-based tokens. Investors can buy these tokens to gain exposure to premium flows and collateral yield – essentially tapping into the same cash flows that have powered traditional reinsurers for decades. The difference? Now it’s transparent, accessible 24/7, and available in bite-sized pieces for smaller investors.

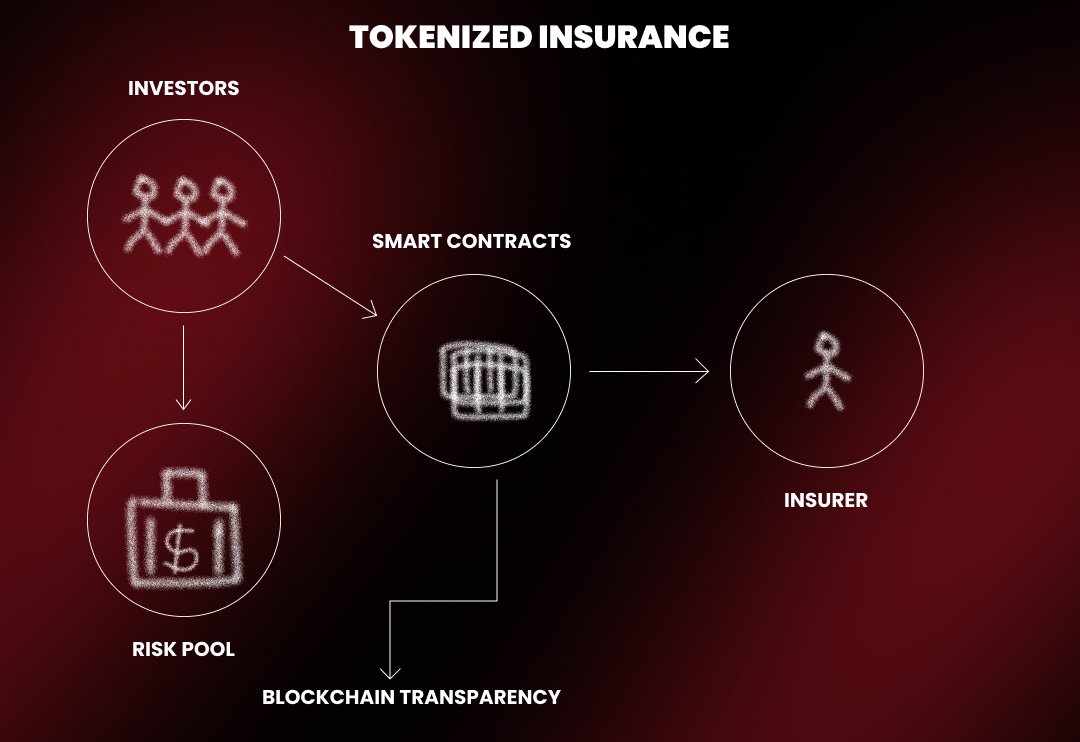

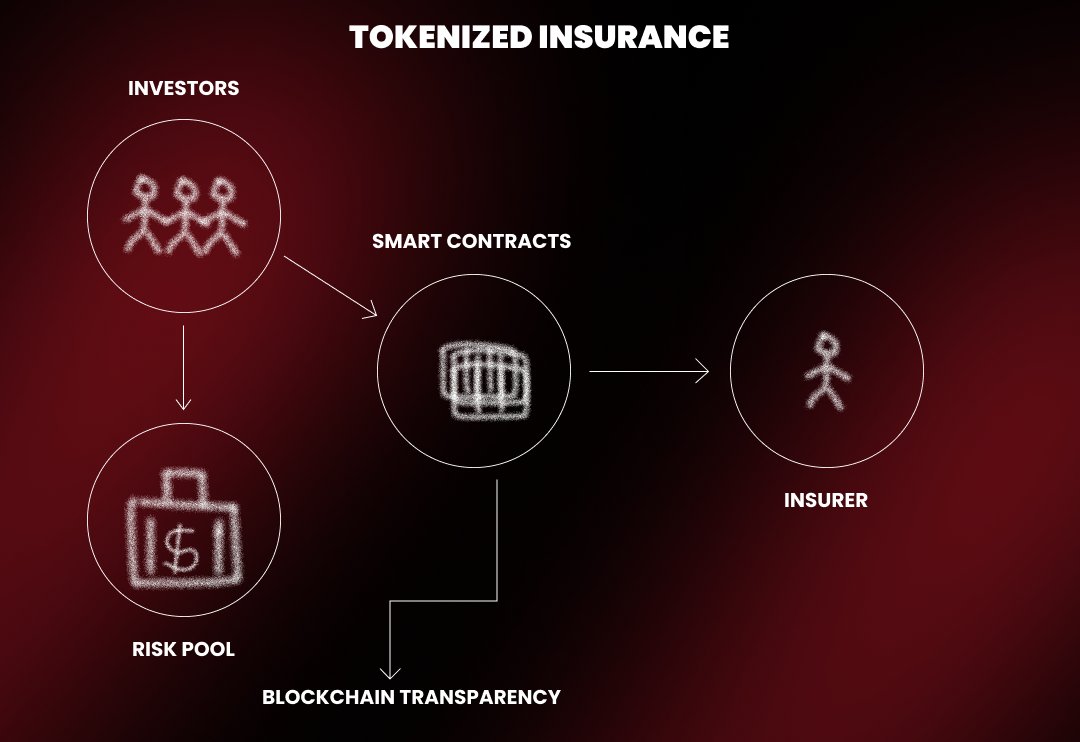

The mechanics are straightforward but powerful:

- Capital is pooled from global investors via smart contracts.

- Risk is underwritten, often by regulated insurers or MGAs (managing general agents).

- Pools backstop real-world insurance policies, earning premiums.

- Payouts for claims are automated on-chain. Remaining capital plus premium yield is distributed to token holders.

This structure means you’re not betting on meme coins or vaporware. Your yield comes from people paying real premiums to insure homes, businesses, or digital assets – a fundamentally different risk profile than most DeFi protocols can offer. For a deep dive on how these mechanics work under the hood, check out this guide on transparency for DeFi investors and insurers.

The Current Market: Real Returns Meet Real-World Assets

The numbers don’t lie: OnRe’s ONe token is projecting up to 40.35% annualized returns for liquidity providers by blending reinsurance performance with collateral yield and native incentives. Oxbridge Re’s ZetaCat Re targets a whopping 42% return, while even its more conservative EtaCat Re aims for 20% – all fully collateralized and open to participants with as little as $5,000.

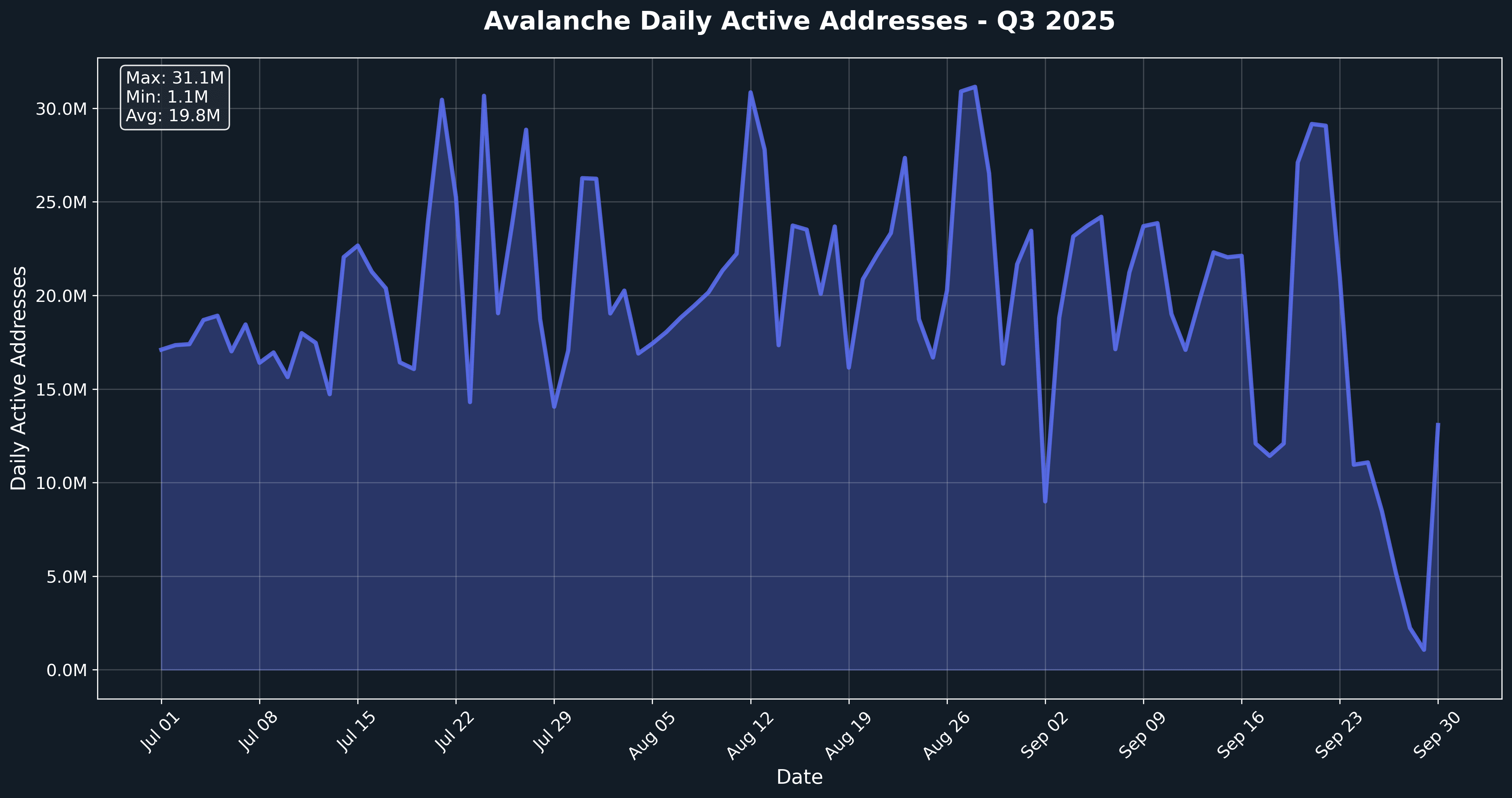

This isn’t just hype; it’s part of a broader trend where real-world assets (RWAs) are being brought on-chain at scale. By linking global capital markets with blockchain rails, platforms like Re. xyz allow anyone to access institutional-grade insurance risk with daily on-chain audits and transparent reporting. It’s no surprise that Avalanche picked up two new products from Re – reUSD (Basis-Plus) and reUSDe (Insurance Alpha) – which combine stablecoin-like stability with insurance-driven alpha.

Diversification and Transparency: Why Investors Are Paying Attention

If you’re an active trader or portfolio manager who lives by “volatility is opportunity, ” here’s where things get tactical:

- Diversification: Yields from tokenized reinsurance pools aren’t correlated with BTC or ETH price swings. That means less portfolio drawdown during crypto selloffs.

- Accessibility: Tokenization lets you allocate small amounts rather than locking up millions in traditional sidecars or ILS funds.

- Transparency: Daily audits on-chain mean you always know how much collateral backs your position and what risks you’re exposed to.

This intersection of principal-protected DeFi yields with real-world risk management is opening new doors for both crypto natives seeking stability and TradFi allocators searching for uncorrelated alpha. For those looking to understand exactly how these protocols tokenize vaults to back actual insurance risk, see our detailed breakdown at how on-chain reinsurance protocols use tokenized vaults.

But let’s not gloss over the real paradigm shift here: tokenized reinsurance pools are changing the risk-reward calculus for everyone. Before this wave of blockchain reinsurance protocols, access to insurance yield was strictly for the big dogs, think Swiss Re, Munich Re, and a handful of hedge funds with deep pockets and even deeper legal teams. Now, with smart contracts automating everything from premium collection to claim payouts, the playing field is wide open. Anyone with a crypto wallet can get exposure to principal-protected DeFi yields that are directly tied to real-world events, not just speculative narratives.

Top Ways Tokenized Reinsurance Pools Unlock On-Chain Yields

-

OnRe’s Blockchain-Backed Yield Products: OnRe has launched the ONe token, giving investors exposure to real-world reinsurance returns, collateral yield, and token incentives. With projected returns of up to 40.35% for liquidity providers, OnRe bridges the $750B global reinsurance market to DeFi, creating scalable, yield-bearing products on-chain.

-

Oxbridge Re’s Tokenized Securities: Through its subsidiary SurancePlus, Oxbridge Re offers tokenized reinsurance securities like ZetaCat Re and EtaCat Re. These products target returns of 42% and 20% respectively, democratizing access to reinsurance investments for as little as $5,000.

-

Re Protocol’s On-Chain Yield Products: Re has expanded on Avalanche with reUSD (Basis-Plus) and reUSDe (Insurance Alpha) tokens, plus the Re Points Program. These offerings combine blockchain transparency with traditional reinsurance exposure, delivering stable, uncorrelated yields to both retail and institutional investors.

-

Portfolio Diversification with Uncorrelated Returns: Tokenized reinsurance pools allow investors to tap into yield streams that are uncorrelated with crypto markets. This means more reliable, stable returns—especially valuable during volatile crypto cycles.

-

Increased Accessibility for All Investors: By lowering minimum investment thresholds and eliminating traditional barriers, tokenized reinsurance pools make institutional-grade yields available to a broader audience, including retail investors.

-

Enhanced Transparency and Trust via Blockchain: Blockchain-based reinsurance pools provide real-time tracking and auditing of contracts, boosting investor confidence and operational efficiency.

Let’s zoom out and look at the bigger picture. As more protocols like Re Protocol, OnRe, and SurancePlus scale up their offerings, we’re seeing a new breed of yield products emerge, ones that blend blockchain transparency with off-chain underwriting discipline. The result? A robust ecosystem where collateralized yield crypto isn’t just marketing spin but is actually backed by daily on-chain audits and real cash flows.

What’s especially compelling is how these products stand up in volatile markets. When crypto takes a nosedive or TradFi yields get squeezed by central banks, tokenized reinsurance pools keep churning out stable returns, because hurricanes and auto accidents don’t care what Bitcoin is doing. This uncorrelated yield is exactly what portfolio managers crave when they want to smooth out those wild P and L swings.

What’s Next?The Road Ahead for Blockchain Reinsurance

The momentum is only getting stronger. As protocols compete to offer higher transparency, lower fees, and seamless integrations with DeFi infrastructure, expect tokenized reinsurance pools to become a core allocation in any serious digital asset portfolio. Regulators are taking notice too, platforms like OnRe are already working under regulated frameworks while still delivering double-digit APY potential.

The next phase? Watch for more granular risk tranching (think junior/senior tokens), better secondary markets for liquidity exit, and integrations with DeFi lending/borrowing platforms so you can use your insurance-backed tokens as collateral elsewhere in the ecosystem. The composability of blockchain means these innovations will move fast, and those who understand both risk management and on-chain mechanics will be first in line for outsized returns.

If you’re ready to go deeper or want tactical strategies for navigating this new market structure, check out our step-by-step guides on how tokenized reinsurance pools deliver real yield on-chain or explore how other protocols are bridging principal-protected DeFi yields with real-world insurance premiums at this resource.

The bottom line: Tokenized reinsurance pools aren’t just another DeFi fad, they’re the future of stable on-chain yield. If you want to be ahead of the curve as capital flows from both TradFi and crypto converge here, now’s the time to dig in.