The reinsurance industry is quietly undergoing a seismic shift, as blockchain technology and digital assets bring new capital and transparency to a traditionally opaque market. Tokenized reinsurance pools are at the center of this transformation, connecting crypto investors directly with real-world insurance risk – and offering stable, uncorrelated yields that stand apart from typical DeFi returns.

What Are Tokenized Reinsurance Pools?

At their core, tokenized reinsurance pools are blockchain-based platforms that let investors provide capital to back insurance risks. In return, they receive digital tokens representing their share of a pool that covers claims for real-world insurance policies. When premiums are paid and losses occur, payouts and profits are automatically distributed via smart contracts – all tracked transparently on-chain.

This model is a radical departure from legacy reinsurance markets, where access has traditionally been restricted to large institutions and processes remain slow and paper-heavy. Now, thanks to tokenization, even individual investors can participate in funding global insurance programs while benefiting from real yield sourced from actual premium flows.

How Blockchain Connects Crypto Capital With Insurance Risk

The magic lies in how these platforms use blockchain’s features to align incentives between capital providers (crypto investors) and risk takers (insurers). Here’s how it works:

- Capital Pooling: Investors deposit stablecoins or other approved tokens into smart contract vaults. Each deposit mints a corresponding token (like reUSD or ONe) that tracks their proportional ownership in the pool.

- Risk Participation: The pooled funds act as collateral backing specific tranches of insurance risk – for example, property catastrophe cover or cyber liability protection. The protocols often partner with regulated insurers or reinsurers who source these risks.

- Payout Automation: When insured events occur (say, a hurricane hits), smart contracts trigger claims payments directly from the pool. Remaining premiums become investor yield, minus fees and any losses.

- On-Chain Transparency: Every transaction – premium paid in, claim paid out – is immutably recorded on public blockchains like Avalanche or Ethereum. This enables real-time audits by anyone.

This structure not only brings new efficiency but also opens up diversification opportunities for crypto holders seeking exposure to uncorrelated real-world assets. For more details on how these mechanisms generate sustainable returns for both sides of the market, see our deep dive: How On-Chain Reinsurance Pools Generate Yield From Real-World Insurance Premiums.

The Rise of Institutional-Grade Platforms

A wave of specialized DeFi protocols is now making it easy for both retail and institutional players to access tokenized reinsurance opportunities:

- Re Protocol: Built on Avalanche, Re lets users deposit stablecoins into fully collateralized insurance layers. Investors receive tokens like reUSD representing distinct risk-return profiles tied to actual insurance treaties.

- Nayms: This marketplace issues NAYM tokens for decentralized governance over pooled risk capital used in crypto-native insurance programs – democratizing access to what was once a $700 billion institutional-only market.

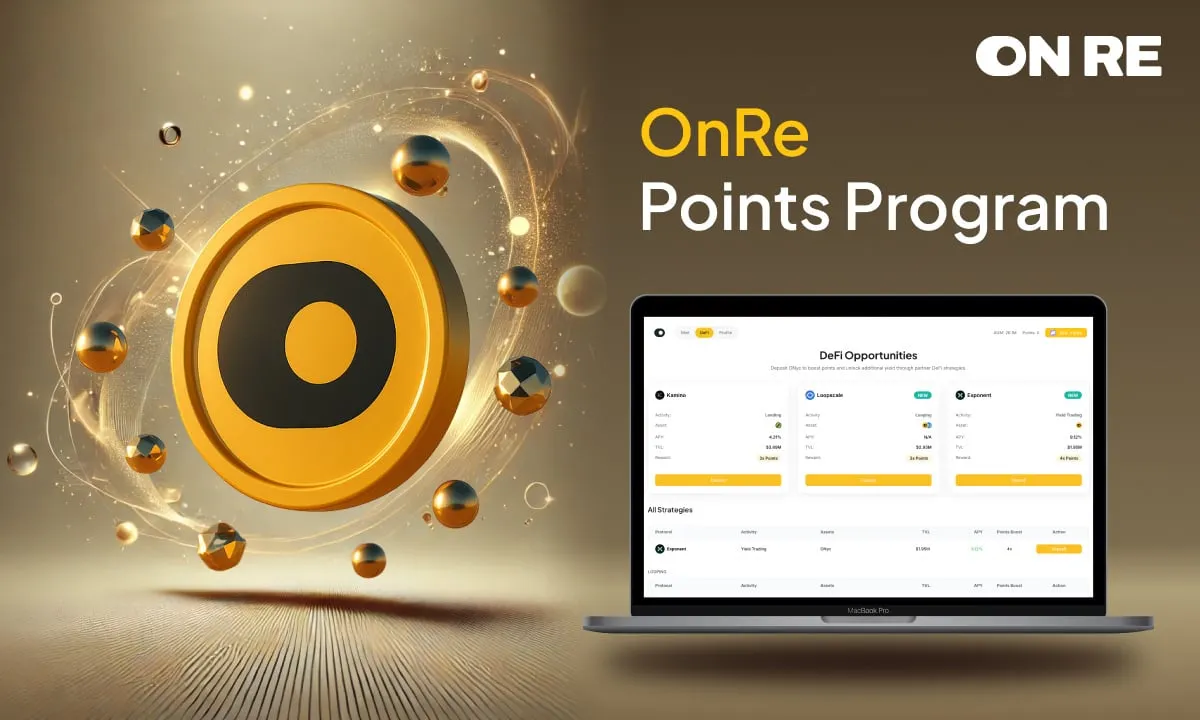

- OnRe: A regulated platform offering ONe tokens linked directly to revenue-generating reinsurance contracts. Their innovative products blend DeFi incentives with traditional underwriting discipline for robust yield potential.

The sector’s momentum is underscored by recent launches such as OnRe’s structured yield product (combining classic reinsurance returns with crypto upside) and digital cat bond offerings boasting projected annualized returns of up to 42%. For investors weary of inflationary DeFi rewards or volatile altcoin markets, these platforms represent an attractive new frontier grounded in tangible economic activity.

Sustainable Yield Meets Radical Transparency

A key advantage of tokenized reinsurance pools over conventional DeFi is their ability to deliver sustainable income streams based on real-world cash flows rather than speculative trading or emissions. Premiums collected from insurers flow into collateral pools; after accounting for claims and fees, what remains is distributed as yield to token holders. This aligns investor interests with underwriting performance rather than hype cycles.

Additionally, blockchain-based systems foster unprecedented transparency compared to legacy finance. All capital movements – deposits, premium collections, claim settlements – are visible on-chain in near-real time. Investors can independently verify solvency ratios and payout histories without relying solely on third-party audits or quarterly disclosures. For more on how this transparency benefits both sides of the market, visit our resource: How Tokenized Reinsurance Pools Work: Real Yield and Transparency For DeFi Investors And Insurers.

For insurance professionals and crypto investors alike, the implications are profound. Tokenized reinsurance pools are not just a novel investment vehicle – they represent a paradigm shift in how risk is underwritten, capitalized, and audited. By leveraging blockchain’s programmability, these platforms can offer tailored risk tranches, automated reporting, and instant settlement cycles that far outpace legacy reinsurance operations.

Top Tokenized Reinsurance Protocols, Blockchains & Yields

-

Re Protocol — Built on AvalancheInvestors can provide stablecoins to back real-world insurance programs and receive yield-bearing tokens (reUSD, reUSDe).Typical Yield Range: 8%–15% APY, depending on risk tranche and market conditions.

-

OnRe — Deployed on EthereumA regulated, on-chain reinsurance platform offering the ONe token, which gives exposure to reinsurance returns, collateral yield, and token incentives.Typical Yield Range: 10%–18% APY, combining reinsurance performance and DeFi incentives.

-

Nayms — Multichain (Ethereum, Polygon, BNB Chain)A crypto-native reinsurance marketplace using the NAYM token for governance and participation in tokenized insurance contracts.Typical Yield Range: 6%–12% APY, varying by insurance pool and contract duration.

-

SurancePlus — Built on EthereumOffers tokenized reinsurance securities for investors seeking high, uncorrelated returns from real-world insurance risk.Typical Yield Range: 12%–20% APY, based on the underlying insurance product and market demand.

One of the most exciting features is the ability to customize risk exposure. Investors can select pools based on geography, peril type (such as property catastrophe or cyber), and even choose between senior or junior tranches to match their risk appetite. This level of granularity was previously available only to large institutional reinsurers. Now, thanks to tokenization and smart contracts, portfolio construction can be as dynamic as any DeFi vault strategy – but anchored in real-world insurance economics.

The sector’s growth has also spurred regulatory innovation. Platforms like OnRe have embraced compliance frameworks that enable them to bridge traditional finance with DeFi participants while maintaining robust KYC/AML standards. This hybrid approach opens the door for broader institutional adoption without sacrificing the core benefits of decentralization and transparency.

Challenges and What Comes Next

Despite rapid progress, tokenized reinsurance pools face important hurdles. Regulatory clarity remains a work in progress across jurisdictions. Risk modeling for on-chain protocols must evolve to account for both blockchain-specific threats (like smart contract exploits) and traditional insurance risks. And investor education is crucial – understanding how claims volatility impacts yield is key to sustainable participation.

Yet the momentum is undeniable. With over $130 million already pooled across multichain protocols by late 2025 and projected annualized returns on certain digital cat bonds reaching up to 42%, tokenized reinsurance is quickly earning its place alongside other real-world asset (RWA) DeFi sectors.

For a practical guide on how these capital pools work from deposit to payout, see How Tokenized Reinsurance Pools Work: A Guide For Crypto Investors.

Why On-Chain Reinsurance Is Here To Stay

The convergence of blockchain technology with global insurance markets has set the stage for a new era of collateralized yield insurance. Tokenized reinsurance pools deliver what many DeFi investors crave: stable returns that are uncorrelated with crypto price swings plus full auditability through blockchain insurance audits.

As protocols mature and regulatory frameworks solidify, expect even greater integration between institutional capital, decentralized infrastructure, and real-world insurance needs. The next wave of innovation may see parametric triggers linked directly to IoT data or cross-chain capital flows supporting multi-peril covers worldwide.

If you’re ready to explore this rapidly evolving space further or want technical details on implementation strategies, check out our resource hub: Tokenization Of Reinsurance Contracts: Benefits And Implementation Strategies.