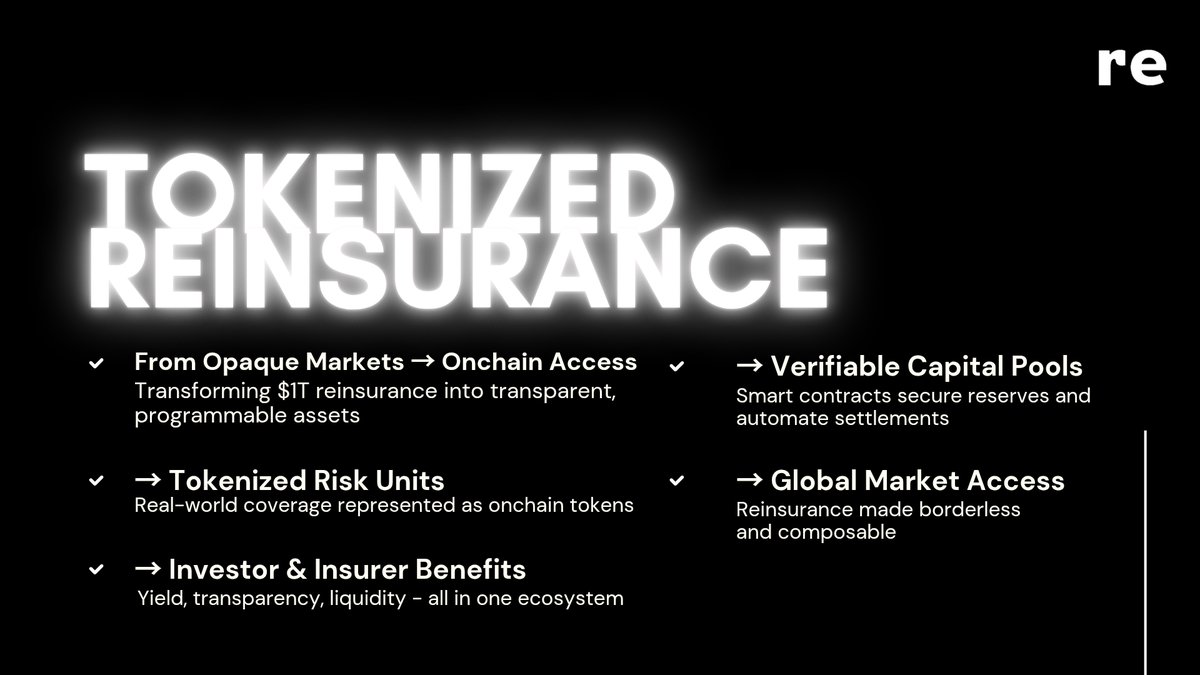

In recent months, reinsurance tokenization has emerged as one of the most compelling frontiers in blockchain-based finance. By converting reinsurance contracts into tradable blockchain tokens, platforms like Re, OnRe, and SurancePlus are unlocking real-world yield opportunities for crypto investors – yields that are not only high, but also uncorrelated with the volatility of digital assets. As the $1 trillion global reinsurance market begins to integrate with DeFi, a new class of on-chain products is rapidly gaining traction, offering both diversification and transparency that was once exclusive to institutional finance.

Tokenized Reinsurance: From Niche Experiment to DeFi Powerhouse

Just a year ago, the idea of earning double-digit yield from insurance yield crypto products seemed far-fetched. Today, it’s reality. In April 2025, Ethena Labs partnered with decentralized reinsurance protocol Re, enabling users to deposit stablecoins like USDe and sUSDe into on-chain reinsurance pools. The result? Potential returns of up to 23% APY, dwarfing most traditional DeFi staking yields. Meanwhile, OnRe’s ONe token, launched in May 2025, projects returns of up to 40.35% for liquidity providers, directly linking investor rewards to the performance of real-world reinsurance contracts and collateral yields. SurancePlus and Oxbridge Re have also entered the arena with ZetaCat Re and EtaCat Re securities, targeting annualized returns of 20% and 42%, respectively.

“Tokenization erases that fault. By converting reinsurance contracts into tradable fractional tokens, a new class of investors can participate, diversify, and earn in ways never before possible. ”

Why Reinsurance Yield is Attracting Crypto Capital

The draw is obvious: on-chain reinsurance yield products offer exposure to a revenue stream that’s grounded in real-world economics – not just speculative trading or protocol inflation. Reinsurance premiums are paid by insurers to transfer risk, providing a relatively stable flow of capital that’s historically been resilient even during market downturns. For crypto investors weary of DeFi’s boom-bust cycles, this represents a rare opportunity to earn yield that isn’t directly tied to ETH or BTC price swings.

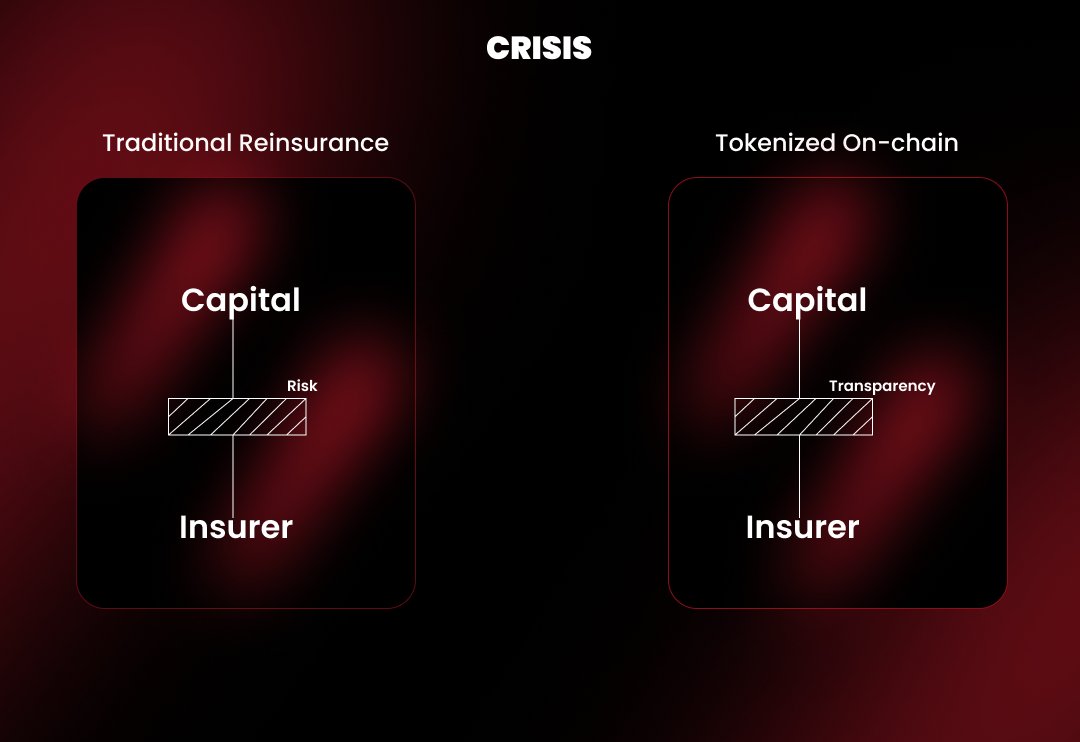

This isn’t just about high returns. Blockchain reinsurance investing brings transparency and efficiency to an industry notorious for opacity and slow settlement. Smart contracts automate premium collection and claims payouts. Investors can monitor their positions in real time on-chain. And fractionalization means even smallholders can access opportunities that once required tens of millions in minimum commitments.

Top 5 Tokenized Reinsurance Protocols in 2025

-

Re: A decentralized reinsurance protocol enabling investors to earn real-world yield by participating in tokenized reinsurance risk pools. Notably, Re partnered with Ethena in April 2025, allowing users to deposit stablecoins like USDe and sUSDe for potential returns of up to 23% APY.

-

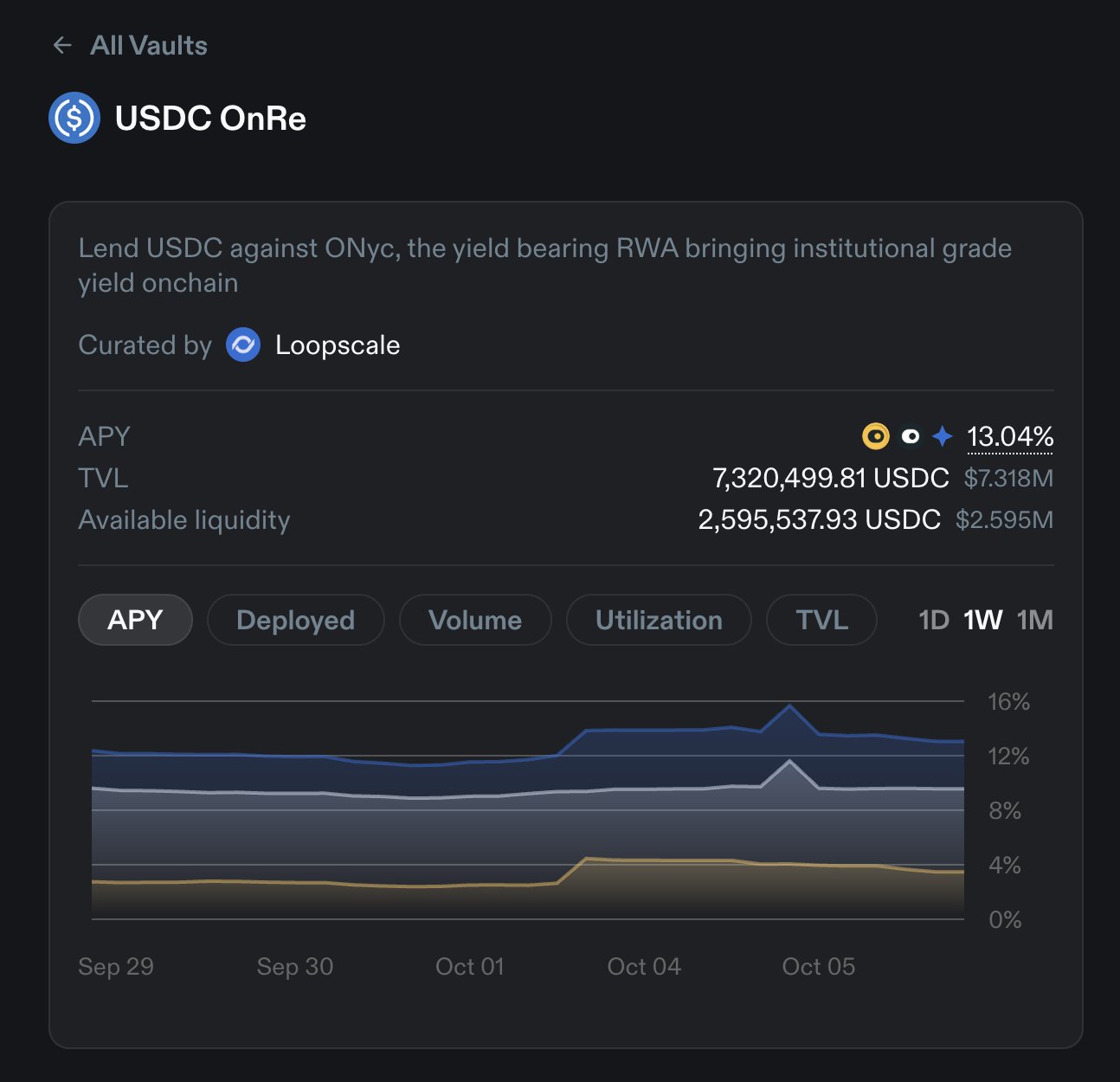

OnRe: Launched its native ONe token in May 2025, providing exposure to reinsurance performance, collateral yield, and token incentives. OnRe projects returns of up to 40.35% for liquidity providers, bridging the global reinsurance market with DeFi.

-

Oxbridge Re / SurancePlus: Through its subsidiary SurancePlus, Oxbridge Re introduced tokenized reinsurance securities such as ZetaCat Re and EtaCat Re for the 2025/2026 treaty year, targeting returns of 20% and 42% respectively. These offerings highlight the growing adoption of blockchain in reinsurance.

-

DeltaCat Re: Operated by SurancePlus, DeltaCat Re is a tokenized reinsurance series on the Avalanche blockchain, structured to offer investors a projected annualized return of 42%. It exemplifies the integration of blockchain with high-yield reinsurance assets.

-

Ethena x Re Integration: This partnership allows Ethena users to access tokenized reinsurance yield by depositing stablecoins into Re’s risk pools. The integration brings stable, non-correlated yield to crypto investors, with advertised returns up to 23% APY.

The Mechanics: How Tokenized Insurance Assets Deliver Real Yield

At its core, decentralized reinsurance protocols pool capital from crypto investors and deploy it as collateral backing real insurance risk – think natural catastrophe bonds or property and casualty treaties. When claims are low, the remaining premium flows back to token holders as yield. If losses occur, investors share in the downside according to transparent smart contract rules.

This model is already being stress-tested at scale. OnRe’s ONe token leverages Chainlink-powered on-chain NAV calculations for transparency and reliability, while Re’s pools integrate with Ethena Labs’ synthetic dollar ecosystem for seamless stablecoin participation. SurancePlus’ ZetaCat Re series operates on Avalanche, offering annualized returns up to 42%. These are not hypothetical projections – they reflect current market offerings as of October 2025.

If you want to dig deeper into the technical structure behind these pools and how real-world risk translates into on-chain returns, see our guide here.

Risk, of course, is not eliminated – but it’s quantified and made transparent. Investors can analyze the underlying insurance treaties, review loss histories, and even track real-time pool performance thanks to immutable blockchain records. This marks a profound shift from the black-box nature of legacy reinsurance funds. For those who remember the 2008 financial crisis or the 2022 DeFi market shocks, this level of visibility is more than a technical upgrade; it’s a psychological one.

What’s especially notable in 2025 is the diversity of products now available. From catastrophe risk on Avalanche (ZetaCat Re, EtaCat Re) to property and casualty treaties via OnRe and synthetic stablecoin pools with Re/Ethena, investors can tailor their exposure based on risk appetite and desired yield. Some protocols offer high-yield tranches with greater risk (up to 42% APY), while others focus on balanced returns (10-23% APY) for those seeking steadier income streams.

What to Watch: Challenges and Next Steps for On-Chain Reinsurance

No innovation comes without hurdles. Regulatory clarity remains a work in progress. Most tokenized reinsurance platforms are careful to operate within existing securities frameworks or partner with regulated entities, but global standards are still evolving. Liquidity is another concern – while secondary markets for these tokens are emerging, they’re not yet as deep as for blue-chip DeFi assets.

Yet momentum is unmistakable. Major institutional investors are beginning to allocate to tokenized insurance assets, drawn by both yield and diversification benefits. As protocols like OnRe and Re continue to integrate with established DeFi primitives (stablecoins, oracles, automated market makers), we’re seeing the birth of a new asset class that sits at the intersection of insurance and crypto finance.

Key Advantages of Decentralized Reinsurance Protocols

-

Higher Yield Potential: Platforms like Re, OnRe, and SurancePlus offer projected returns from 20% up to 42% APY, significantly outpacing traditional insurance-linked securities (ILS) and typical DeFi staking yields.

-

Real-World, Non-Correlated Yield: Tokenized reinsurance contracts provide exposure to real-world insurance premiums, generating returns that are uncorrelated with crypto market volatility—helping investors diversify and reduce risk.

-

Fractional Ownership & Accessibility: By converting reinsurance contracts into blockchain tokens, platforms like OnRe and Oxbridge Re allow a broader range of investors—including individuals—to access opportunities previously reserved for institutional players.

-

Enhanced Transparency & Efficiency: Blockchain-based protocols deliver real-time settlement, on-chain tracking, and increased transparency compared to the opaque, slow processes in traditional ILS markets.

-

Expanded Capital Sources for Insurers: Tokenized reinsurance opens new capital channels, enabling insurers to tap into the global pool of digital asset investors—potentially lowering costs and increasing market resilience.

For forward-thinking investors, the implications are profound: access to yield streams once reserved for billion-dollar institutions; real-time data transparency; fractional ownership that levels the playing field globally. As capital flows accelerate into this sector through 2025 and beyond, expect further innovation in risk modeling, secondary trading venues, and cross-chain interoperability.

To explore more about how these protocols deliver sustainable yield on-chain, and what to look for when evaluating new opportunities, check out our deep-dive analysis here.

The future of on-chain reinsurance yield isn’t just about capturing high returns, it’s about building a more resilient financial system where risk is shared openly and rewards flow transparently. As always: invest for the future you want.