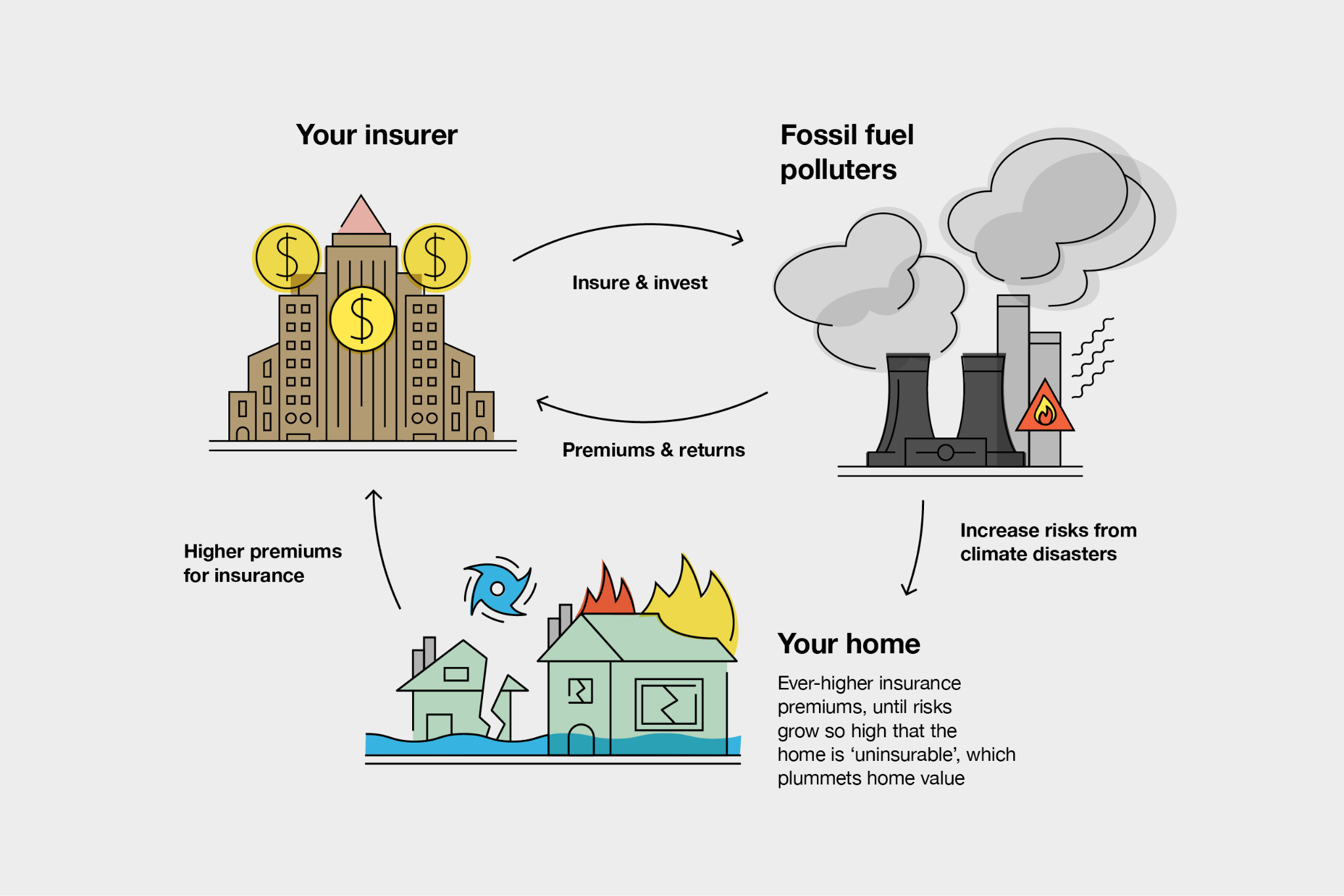

DeFi is no stranger to yield experiments, but 2025 has thrown open the doors to a new, uncorrelated asset class: tokenized reinsurance. Forget staking tokens on the latest farm or chasing fleeting APYs. Now, you can earn real-world yield from the $750 billion global reinsurance market, right from your wallet. This is more than just another RWA narrative. It’s the next stage in DeFi’s evolution, blending insurance risk, blockchain transparency, and on-chain liquidity to create yield streams that don’t care what Bitcoin, ETH, or the broader crypto market are doing.

How Tokenized Reinsurance Works: From Obscure to On-Chain

At its core, tokenized reinsurance takes the performance of real insurance contracts, think catastrophe bonds, property casualty risk, or specialty insurance pools, and packages them into blockchain-based tokens. These tokens represent fractional ownership of the underlying risk and premium flows, unlocking access for DeFi investors who previously had zero way in.

Platforms like OnRe and Re Protocol are leading the charge. In May 2025, OnRe launched its ONe token, giving DeFi users exposure to yields from reinsurance performance, collateral returns, and token incentives. The projected returns? Up to 40.35% for liquidity providers, according to recent disclosures. Meanwhile, Ethena’s partnership with Re lets USDe and sUSDe holders lock up their stablecoins as reserve assets for insurance companies, earning up to 23% APY. These are not theoretical numbers, these are live, on-chain yields, backed by real-world insurance premiums and risk transfer.

Why DeFi Investors Are Flocking to Reinsurance Blockchain Yields

The appeal is obvious: uncorrelated, stable, and accessible yield. Traditional insurance and reinsurance markets have always been the playground of institutional giants. But with blockchain, anyone can buy a slice of the action. Here’s why tokenized reinsurance is catching fire:

Top 5 Reasons DeFi Users Allocate to Tokenized Reinsurance

-

Uncorrelated, High-Yield Returns: Tokenized reinsurance pools like OnRe’s ONe Token and Oxbridge Re’s ZetaCat Re & EtaCat Re offer projected returns up to 40.35% and 42%—far above typical DeFi yields, and crucially, these returns are not directly tied to crypto market swings.

-

Real-World Asset (RWA) Diversification: By allocating to tokenized reinsurance, DeFi users gain exposure to the $750 billion global reinsurance market, adding a new, uncorrelated asset class to their crypto portfolios for enhanced risk management.

-

Stable, Predictable Income Streams: Returns are generated from insurance premium flows—a steady, real-world revenue source—helping investors achieve more reliable, less volatile yields compared to many crypto-native products.

-

Fractional Ownership & Accessibility: Platforms like Re and OnRe enable investors to participate with smaller amounts, democratizing access to reinsurance opportunities once reserved for institutional giants.

-

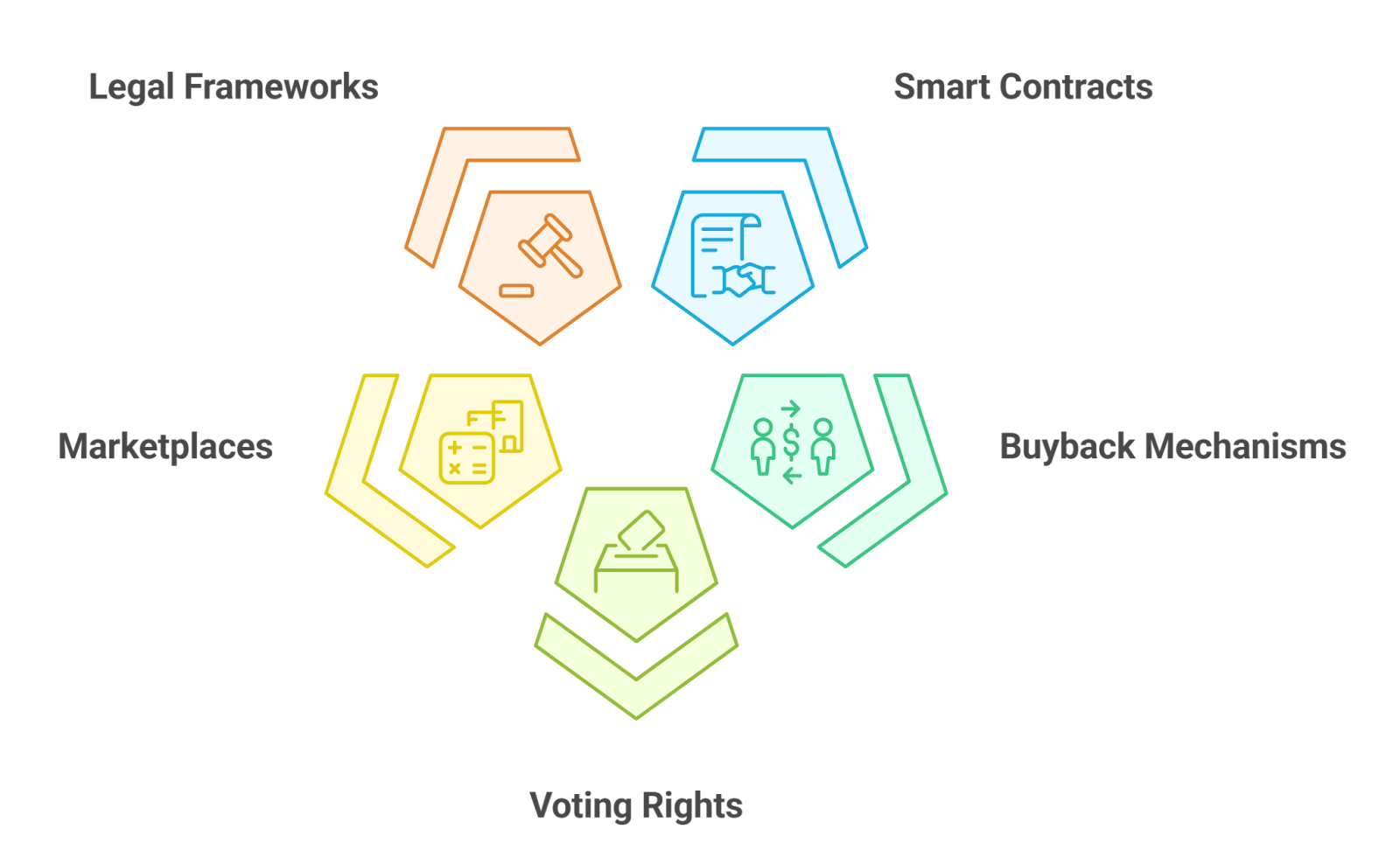

On-Chain Transparency & Automation: Blockchain infrastructure ensures real-time settlement, automated payouts, and transparent tracking of reinsurance contracts, reducing operational risks and boosting investor confidence.

- Diversification: Insurance risk doesn’t move with crypto cycles, stocks, or macro events. It’s its own beast.

- Stable Yields: Returns are sourced from insurance premiums, not speculative trading or unsustainable emissions.

- Fractional Ownership: Investors can participate with any amount, thanks to tokenization. No $1 million minimums here.

- Automation and Transparency: Smart contracts automate payouts, collateral management, and reporting, all on-chain.

- Real-Time Settlement: No more waiting months for distributions, yields accrue and settle in real time.

What’s Live Right Now: Real-World Yield, Real Numbers

Let’s get tactical. Here’s what’s actually running on-chain as of October 2025:

- OnRe’s ONe Token: Up to 40.35% projected returns for LPs, with exposure to a diversified basket of reinsurance contracts. See how it works.

- Ethena x Re Protocol: USDe and sUSDe stakers can earn up to 23% APY by supporting real insurance companies via the Re protocol. Read the deep dive.

- Oxbridge Re’s Tokenized Securities (ZetaCat Re, EtaCat Re): Targeting returns of 20% and 42%, respectively, with performance tracking ahead as hurricane season closes.

This isn’t just hype. These protocols are settling claims, distributing premium income, and reporting results, all on-chain. For a breakdown of how these pools operate under the hood, check out this explainer.

But let’s not gloss over the risks. Smart contract bugs, oracle failures, and regulatory shifts remain real concerns for anyone venturing into tokenized reinsurance. As highlighted by Continuum, issues with price feeds or redemption mechanisms could impact the logic behind fractional ownership and payouts. That said, the transparency of blockchain means these risks are at least visible and auditable, something the legacy reinsurance market can’t claim.

Risk Management and On-Chain Claims: Where Blockchain Shines

One of the most powerful aspects of reinsurance blockchain protocols is on-chain claims settlement. When an insurance event triggers a payout, smart contracts execute automatically, no middlemen, no opaque processes. This not only reduces operational friction but also slashes settlement times from months to minutes. For DeFi investors, this means more predictable cash flows and less uncertainty about when (or if) you’ll see your premium income.

The move toward insurance risk tokenization is also making previously illiquid assets tradable. Secondary markets for fractional reinsurance tokens are emerging, letting investors buy or sell exposure as their risk appetite shifts. This is a seismic upgrade over the traditional model, where you’d be locked into a contract until maturity, or not even have access at all.

What’s Next? The Real-World Yield Race Is On

The floodgates are open. As more protocols tokenize insurance risk, DeFi users get access to an expanding menu of real-world yield strategies. Expect to see:

- Bigger pools: Institutional insurers will increasingly tap on-chain capital for retrocession and risk transfer.

- Diversified products: Beyond catastrophe risk, expect life, health, cyber, and specialty lines to be tokenized next.

- Tighter integrations: DeFi platforms will plug directly into reinsurance pools for seamless collateral movement and automated underwriting.

- More transparency: Real-time reporting dashboards will become standard, helping investors monitor risk and performance 24/7.

If you’re serious about building a resilient DeFi portfolio, it’s time to look beyond synthetic yields and consider what real-world risk can do for your returns. The technology is here, the yields are live, and the market is only getting deeper.

The bottom line? Tokenized reinsurance isn’t just another RWA trend, it’s a structural shift in how risk and capital interact on-chain. Whether you’re a crypto native chasing stable yield or an institutional allocator hunting for diversification, this is a corner of DeFi you can’t afford to ignore. Watch this space, real-world yield is officially on-chain.